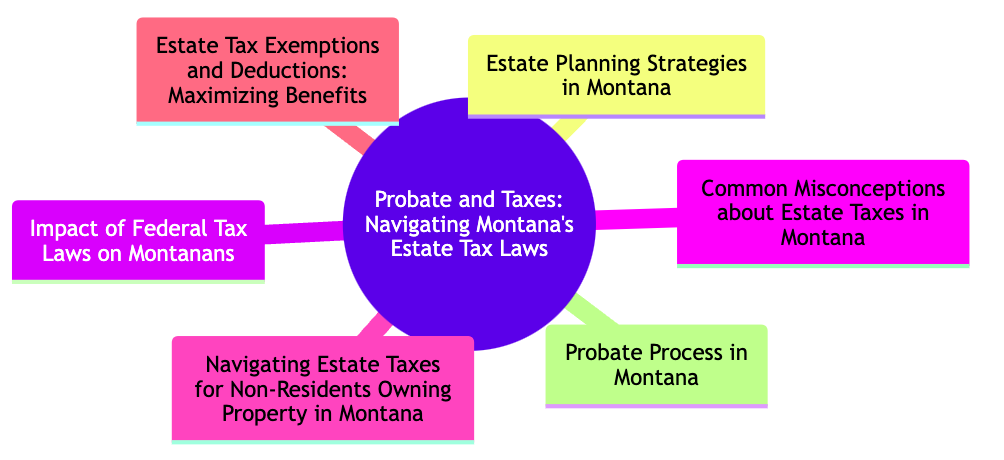

Understanding Estate Taxes in Montana

Montana stands out in the realm of estate taxation, offering a unique landscape that differs significantly from many other states. In Montana, residents face a distinctive set of rules and exemptions when it comes to estate taxes, making it crucial for individuals and families to understand the nuances of these laws. This understanding is vital not only for estate planning but also for ensuring compliance and optimizing tax benefits.

Key Takeaways

- Montana does not levy an estate tax.

- The federal estate tax applies to estates above certain thresholds.

- No state inheritance tax in Montana.

- Importance of estate planning despite tax exemptions.

- Strategies for minimizing federal estate tax.

The Federal Estate Tax: What Montanans Need to Know

The federal estate tax, often a topic of concern for many, plays a significant role in estate planning for Montanans. Despite Montana's lack of a state estate tax, the federal estate tax still applies to estates exceeding certain value thresholds. This tax is calculated on the entire value of an estate, including cash, real estate, investments, and other assets. Understanding these thresholds and the applicable rates is crucial for effective estate planning and avoiding unexpected tax burdens.

Federal Estate Tax Rates and Exemptions

Montana's approach to Federal Estate Tax Rates and Exemptions is characterized by a progressive tax system, where the rate increases with the estate's value. Here's a breakdown of how it works:

- Estates valued at $1 to $10,000 are taxed at 18%, marking the starting point of the tax rate.

- When the estate value is between $10,000 and $20,000, the tax rate is set at 20%.

- For estate values that range from $20,000 to $40,000, the applicable tax rate rises to 22%.

- Additionally, there are significant exemption limits in place. For instance, in 2022, estates valued up to $12.06 million are exempt from these taxes, and this exemption limit increases to $12.92 million in 2023.

- This progressive rate structure ensures that larger estates pay a higher percentage in taxes, aligning with the principles of progressive taxation.

Estate Planning Strategies in Montana

In Montana, estate planning is a critical process, tailored to safeguard assets and ensure they are passed on according to one's wishes. The cornerstone of this process lies in the strategic use of trusts, wills, and charitable giving. Trusts, particularly, offer a versatile tool for asset management and protection, allowing for a controlled distribution of assets to beneficiaries. Wills, on the other hand, provide a clear directive on how assets should be allocated upon death. Charitable giving, integrated into estate planning, not only fulfills philanthropic desires but can also offer tax advantages. Together, these tools form a robust framework, empowering Montanans to craft a legacy that aligns with their values and goals.

Probate Process in Montana

The probate process in Montana is a critical pathway to settling an estate. It involves validating a will, inventorying assets, paying debts and taxes, and distributing the remaining assets as per the will or state law. This process ensures the legal transfer of assets and provides a clear closure to financial and legal matters of the deceased.

- Filing the will and petition in probate court.

- Notifying heirs and creditors.

- Inventorying and appraising the estate's assets.

- Paying debts and taxes owed by the estate.

- Distributing the remaining assets to rightful heirs.

Impact of Federal Tax Laws on Montanans

The impact of federal tax laws on estate planning in Montana is profound and multifaceted. As these laws evolve, they present both challenges and opportunities for Montanans. To effectively navigate this landscape, understanding and adapting to these changes is crucial. Here's how Montanans can optimize their estate planning in light of federal tax laws:

- Comprehend Federal Estate Tax Exemption Limits: It's vital to understand the current federal estate tax exemption limits. These limits determine the threshold at which your estate becomes liable for federal taxes. Staying informed about these limits can help you plan your estate to minimize potential tax liabilities.

- Assess Gift Tax Implications: Gift taxes can significantly affect your estate planning. Recognizing how gifting assets now may impact your estate's future tax obligations is essential. Strategic gifting can be a powerful tool in reducing the overall taxable estate.

- Stay Agile with Tax Law Changes: Tax laws are not static; they change over time. Keeping abreast of recent legislative changes ensures that your estate plan remains compliant and effective. This might involve revising wills, trusts, or other estate planning documents to align with new regulations.

- Utilize Tax Exemptions and Deductions: Effectively leveraging available tax exemptions and deductions can substantially reduce your estate's tax burden. This includes understanding how marital and charitable deductions work and how they can be integrated into your estate planning to achieve tax efficiency.

By focusing on these aspects, Montanans can ensure their estate planning is robust, compliant, and optimized in the face of evolving federal tax laws.

Common Misconceptions about Estate Taxes in Montana

Myth vs. Reality in Estate Taxation

A common myth is that all estates are subject to heavy taxation. In reality, many estates fall below the federal tax exemption threshold, making them exempt from federal estate taxes. Understanding these thresholds is key to dispelling fears and misconceptions.

Understanding the "Death Tax"

The term "death tax" often misleads people into thinking all estates are heavily taxed at death. This tax only applies to estates exceeding certain federal thresholds, which are quite high.

The Role of Inheritance Taxes in Montana

Contrary to popular belief, Montana does not impose a state inheritance tax. This misconception often leads to unnecessary worry among residents. Knowing the actual tax landscape is crucial for effective estate planning.

Navigating Estate Taxes for Non-Residents Owning Property in Montana

Non-residents who own property in Montana face a unique set of tax implications. While Montana itself does not impose an estate tax, non-residents must consider how their property in Montana might be affected by estate taxes in their home state or at the federal level. Non-residents must understand these nuances to ensure proper estate planning and avoid unforeseen tax liabilities.

Tax Implications: Non-Residents vs. Residents

|

Scenario |

Resident of Montana |

Non-Resident with Montana Property |

|

Estate Tax |

No state estate tax |

Subject to home state and federal taxes |

|

Inheritance Tax |

No inheritance tax |

Varies based on home state laws |

|

Property Tax |

Standard rates apply |

Standard rates apply with potential non-resident adjustments |

Estate Tax Exemptions and Deductions: Maximizing Benefits

In Montana, while there is no state estate tax, understanding federal exemptions and deductions is key to maximizing estate benefits. These exemptions and deductions can significantly reduce the taxable value of an estate, thereby lowering the overall tax burden. Estate planners and individuals need to stay informed about these options to make the most of their estate planning.

Estate Tax Exemptions and Deductions

- Federal Estate Tax Exemption: This exemption applies to estates under a certain value threshold, effectively reducing or eliminating the federal estate tax for these estates. It's a crucial consideration for estate planning, as it can significantly impact the overall tax liability of an estate.

- Marital Deduction: This provision allows for unlimited transfers of assets to a surviving spouse without incurring federal estate tax. It's an essential tool for married couples in estate planning, ensuring that the surviving spouse can inherit assets without a hefty tax burden.

- Charitable Deduction: This deduction is for contributions made to qualifying charitable organizations. It reduces the taxable value of an estate, which can be a strategic way to lower estate tax liabilities while supporting charitable causes.

Conclusion: Preparing for the Future

Understanding Montana's estate tax laws is crucial for effective estate planning. Whether you're a resident or a non-resident with property in Montana, being aware of the tax implications, exemptions, and deductions can make a significant difference in your estate planning strategy. Montana Elder Law, with its expertise in navigating these complex laws, stands as a valuable resource for anyone looking to secure their legacy and ensure their estate is handled according to their wishes. Their guidance is instrumental in preparing for the future, ensuring peace of mind for you and your loved ones.