Introduction: Inflation and Retirement Savings

Inflation erodes the purchasing power of your retirement savings.

Over time, the same amount of money buys fewer goods and services. Understanding how inflation impacts your long-term financial security is essential.

Montana Elder Law has put this article together to offer some guidance on key economic observations and how inflation-proofing retirement savings can benefit you in the long-run.

Key Takeaways

- Inflation reduces the value of money over time.

- Investment strategies can help mitigate inflation's impact.

- Fixed incomes are particularly vulnerable to inflation.

- Understanding inflation is crucial for retirement planning.

- Inflation protection requires proactive financial management.

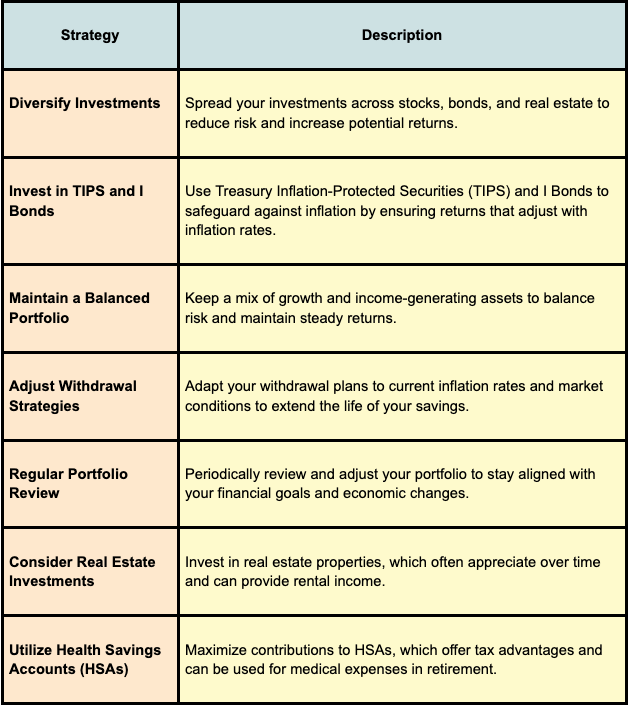

Table 1: Ways to Overcome Inflation for Retirement Savings

Understanding Inflation and Its Effects

Inflation is the rate at which the general level of prices for goods and services rises, decreasing purchasing power.

It's typically measured by the Consumer Price Index (CPI), which tracks the price changes of a basket of goods and services over time.

Several factors cause inflation, including increased demand, rising production costs, and monetary policy.

As prices rise, each dollar saved buys less than it did before.

For retirees, this means that without adequate growth, their savings might not cover future expenses. Inflation impacts everything from groceries to healthcare, making it vital to consider when planning for retirement.

Higher interest rates often accompany inflation, which can affect the returns on bonds and savings accounts. It’s crucial to implement strategies that outpace inflation to preserve the value of your retirement savings.

How Inflation Impacts Retirement Savings

Inflation directly affects retirement savings by reducing their purchasing power and increasing the costs of goods and services.

As prices rise, retirees may find their fixed incomes insufficient to maintain their standard of living.

This erosion can significantly impact the sustainability of their savings and necessitate adjustments in withdrawal strategies to compensate for rising costs.

- Erodes fixed incomes.

2. Increases medical and healthcare costs.

3. Affects the real value of pensions.

4. Impacts the sustainability of savings.

5. Requires adjustments in withdrawal strategies.

Strategies to Protect Retirement Savings from Inflation

Diversifying Investments

Diversifying investments helps mitigate inflation risks.

A well-diversified portfolio includes a mix of stocks, bonds, and real estate. Stocks often outpace inflation over the long term, providing growth potential. Bonds offer stability, while real estate can provide both income and appreciation.

Together, these assets help balance risk and return.

Investing in Inflation-Protected Securities

Treasury Inflation-Protected Securities (TIPS) and I bonds are valuable tools against inflation. TIPS adjust their principal based on inflation rates, so your investment grows with rising prices.

I bonds, similarly, offer a fixed rate plus an inflation rate, protecting your purchasing power.

Maintaining a Balanced Portfolio

Maintaining a balanced portfolio with a mix of growth and income-generating assets is crucial.

A combination of equities, fixed income, and alternative investments can provide stability and growth. Regularly rebalancing your portfolio ensures it stays aligned with your risk tolerance and financial goals.

Adjusting Withdrawal Strategies

Adjusting withdrawal strategies to account for inflation is essential. The 4% rule, which suggests withdrawing 4% of your retirement savings annually, may need adjustments based on inflation rates.

Consider a more flexible withdrawal plan that accounts for market conditions and inflation to preserve your savings' longevity.

The Role of Social Security and Pensions

Social Security and pensions offer some inflation protection but have limitations.

Social Security provides annual cost-of-living adjustments (COLA) to help retirees keep pace with inflation. However, private pensions often lack such adjustments, and public sector pensions vary by state.

- Social Security cost-of-living adjustments (COLA).

- Limitations of private pension plans.

- Public sector pension adjustments.

- Impact of inflation on fixed pension benefits.

- Strategies to supplement pension income.

Common Questions and Answers

How will inflation affect my retirement savings?

Inflation reduces the purchasing power of your savings, meaning you can buy less with the same amount of money over time.

How to inflation-proof your retirement savings?

Diversify your investments by including assets like Treasury Inflation-Protected Securities (TIPS), stocks, and real estate.

These can help your savings grow and keep pace with inflation.

How do retirees fight inflation?

Retirees can combat inflation by adjusting their withdrawal strategies, investing in growth-oriented assets, and regularly reviewing their financial plans to adapt to economic changes.

Are savings accounts worth it with inflation?

While savings accounts are safe, they often offer returns lower than the inflation rate.

Consider higher-yielding investments to protect your money's value over time.

Why are retired people hurt by inflation?

Retired individuals often live on fixed incomes, which lose value as the cost of living rises. This makes it harder to maintain the same standard of living without proper planning.

How to protect your retirement from nagging inflation?

Protect your retirement by regularly reviewing and adjusting your investment portfolio, staying informed about economic trends, and considering inflation-protected securities.

Successful Retirement Planning with Montana Elder Law

Inflation significantly impacts retirement savings by reducing purchasing power and increasing living costs.

Some effective mitigation approaches include diversifying investments and adjusting withdrawal strategies. Staying informed and adaptable is key to maintaining financial security in retirement.

Montana Elder Law is here to help you. We have the expertise to tailor an estate plan to optimize your retirement savings and let you get the most out of your hard-earned retirement.

Call today for more information!