What is a Medicaid Asset Protection Trust (MAPT)?

A Medicaid Asset Protection Trust (MAPT) is a type of irrevocable trust designed to protect assets from being counted when determining Medicaid eligibility. By placing assets in a MAPT, individuals can qualify for Medicaid long-term care benefits without depleting their life savings.

The purpose of a MAPT is twofold: to protect valuable assets from Medicaid's asset limits and to guarantee that those assets can be passed on to beneficiaries. MAPTs are a crucial part of Medicaid planning for those who do not align with eligibility requirements.

This article from Montana Elder Law describes everything you need to know about Medicaid Asset Protection Trusts and how an elder law attorney can help.

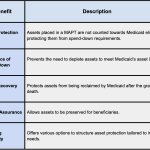

Benefits of Medicaid Asset Protection Trusts

Creating a MAPT can be highly beneficial.

It safeguards assets while facilitating Medicaid eligibility. This trust can provide significant advantages for both the grantor and their beneficiaries.

How Medicaid Asset Protection Trusts Work

Structure of a MAPT

A Medicaid Asset Protection Trust (MAPT) involves three key roles: the grantor, the trustee, and the beneficiaries.

The grantor creates the trust and transfers assets into it.

The trustee manages the trust assets according to the grantor's instructions, while the beneficiaries are the individuals who will eventually receive the benefits from the trust.

Irrevocability and Its Importance

A MAPT must be irrevocable, meaning the grantor cannot alter or cancel it once it's created.

This irrevocability means that the assets will not be considered part of the grantor's estate. A trust like this is necessary if you are exempt from Medicaid's asset limits.

Funding the Trust

Funding a MAPT involves transferring various types of assets into the trust.

Commonly included assets are real estate, financial investments, cash savings, and valuable personal property.

Adequate funding of the trust is necessary for it to serve its purpose effectively.

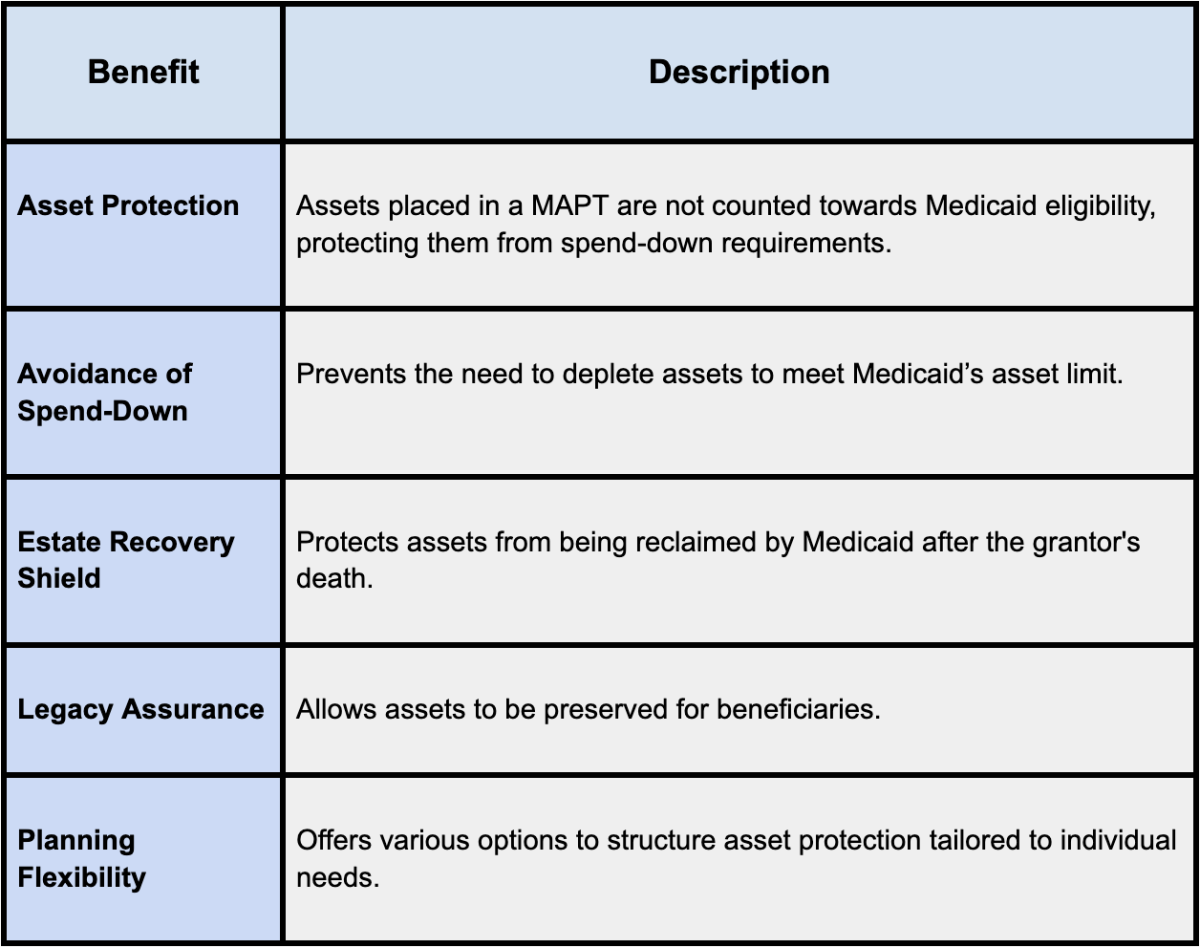

Medicaid Eligibility Requirements for Montana (2024)

The Role of an Elder Law Attorney in Setting Up a MAPT

An elder law attorney is essential in creating a Medicaid Asset Protection Trust (MAPT).

They bring specialized knowledge to navigate state-specific legal requirements and customize the trust to meet your needs. Their expertise helps avoid costly mistakes and provides the necessary protections.

Here’s what they do:

- Initial Consultation: Assess your financial situation and needs.

- Drafting the Trust: Create a trust document that meets legal standards and your specific goals.

- Asset Transfer: Guide you in transferring assets into the trust properly.

- Compliance: Ensure all actions comply with Medicaid rules to avoid penalties.

- Ongoing Support: Offer continued assistance to manage and update the trust as needed.

Cost and Considerations

Setting up a MAPT involves various costs based on complexity and location. Typically, the cost to set of a MAPT is between $2000-$7500, depending on a few different factors.

Factors affecting cost:

- Complexity of the Trust: More complex provisions require more drafting and legal work.

- Geographic Location: Legal fees vary by region.

- Attorney's Expertise: Highly experienced attorneys may charge more.

- Additional Services: Costs can increase with additional services like ongoing trust management.

Common Misconceptions About MAPTs

Many people confuse MAPTs with other types of trusts.

Unlike revocable trusts, MAPTs are irrevocable, which means they cannot be changed once established. This irrevocability is what allows the trust assets to be excluded from Medicaid's asset calculations.

Timing is another critical consideration.

To avoid Medicaid's look-back period penalties, the MAPT should be set up well in advance of needing long-term care. Early planning is key to maximizing a MAPT's benefits and effectively protecting your assets.

Alternatives to Medicaid Asset Protection Trusts

There are several strategies to protect assets apart from Medicaid Asset Protection Trusts (MAPTs).

Each has its unique benefits and can be tailored to individual needs. Let's look at some effective alternatives.

Alternatives

- Irrevocable Funeral Trusts: These trusts cover funeral expenses and are exempt from Medicaid's asset limits.

- Medicaid Compliant Annuities: These annuities convert assets into income streams, reducing countable assets.

- Spend-Down Strategies: This involves spending excess assets on legitimate expenses to meet Medicaid eligibility.

- Personal Care Agreements: Contracts that compensate family members for providing care, reducing countable assets.

- Lady Bird Deeds: These deeds transfer property upon death, avoiding probate and keeping assets from Medicaid recovery.

Closing Remarks: Meeting Medicaid Eligibility with Medicaid Asset Protection Trusts

Medicaid Asset Protection Trusts and their alternatives can safeguard your financial future and provide peace of mind. Each strategy offers unique benefits and can be a valuable part of your Montana estate planning toolkit.

Montana Elder Law is here to help you understand these options and create a plan that suits your needs. Our team is dedicated to providing personalized, expert advice to protect your assets and secure your legacy.

Contact us today to start planning for a secure future.