Planning for Medical Expenses During Retirement

Effective healthcare planning for retirement involves estimating future medical costs (considering inflation), reviewing Medicare and supplemental coverage, and setting aside savings for out-of-pocket expenses.

Healthcare planning is an essential part of retirement. It is a major part of a comprehensive financial strategy. Life expectancies and medical costs are both on the rise - we live longer and must pay for more visits to the doctor! These costs can easily become the biggest financial burden for retirees.

Luckily, there are experts out there who are devoted to guiding seniors toward a sustainable and comfortable retirement. Montana Elder Law is a dedicated resource for all things elder law - trusts, HSAs, annuities, long-term care - Montana Medicaid planning - we provide sound legal advice for all these and more.

Continue reading for more actionable insights on how to plan for healthcare costs throughout retirement!

Key Takeaways About Healthcare Planning

- Start planning for healthcare expenses early. The sooner you factor healthcare into your retirement strategy, the better.

- Consider both Medicare and supplemental coverage. Original Medicare alone may not be enough to cover all your medical needs.

- Plan for long-term care. Many retirees need assistance with daily activities, which Medicare doesn’t cover.

- Account for out-of-pocket expenses. Deductibles, copays, and premiums add up over time.

- Stay informed on Medicare updates. Medicare policies change annually, so it's important to review your options regularly.

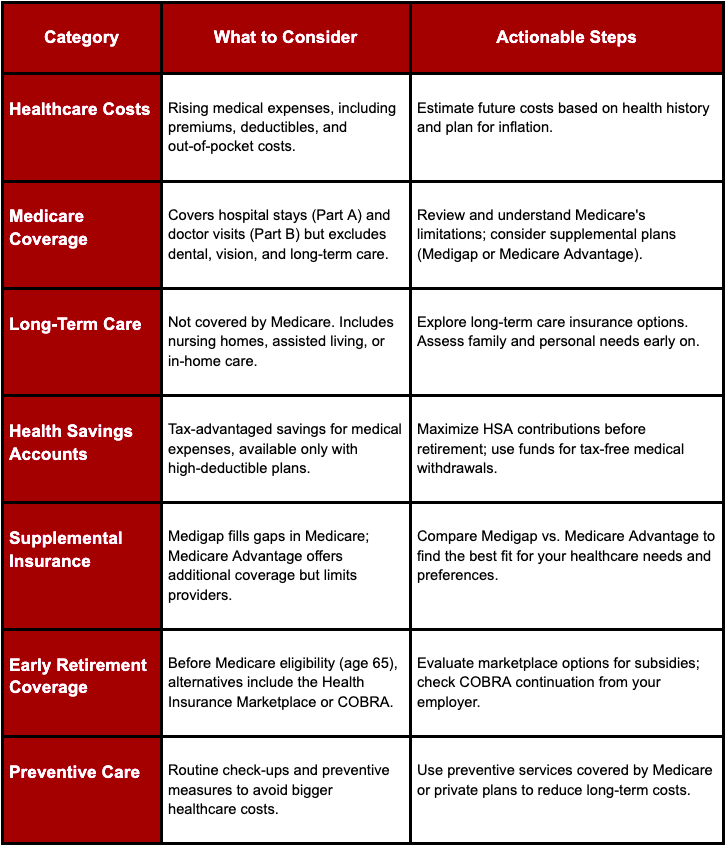

Key Considerations for Retirement Healthcare Planning

Estimating Healthcare Costs in Retirement

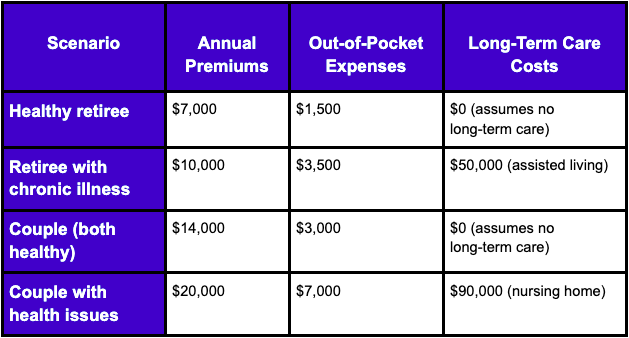

Not all retirees face the same healthcare costs.

A healthy retiree might spend less than someone with a chronic illness, but even healthy individuals should expect to face increasing medical expenses as they age.

On average, a couple retiring at age 65 can expect to spend over $300,000 on healthcare during their retirement.

This figure includes premiums, out-of-pocket costs, and long-term care. It does not account for unexpected medical emergencies. Inflation only adds to these costs, making it important to plan accordingly.

Estimated Healthcare Costs for Retirees

Understanding Medicare: What’s Covered, What’s Not

Medicare provides retirees (aged 65 and older) the essential healthcare coverage they need - but remember, it doesn't cover everything.

Medicare is grouped into four parts:

Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage plans), and Part D (prescription drug coverage).

Parts A and B cover hospital stays, doctor visits, and some preventive services. These are pretty general and encompassing, but there are still plenty of services NOT COVERED.

For instance, dental, vision, hearing aids, and most long-term care services are not included. These categories are where retirees often face unexpected expenses, which is why additional planning is so important.

To bridge these gaps, many retirees turn to Medicare Advantage or Medigap plans.

These options offer expanded coverage - for added premiums and with limitations. It’s essential to review your healthcare coverage options annually.

Understanding these gaps in coverage helps you make informed decisions about supplemental insurance and ensures you have the protection you need without paying for unnecessary coverage.

Supplemental Medicare Coverage

Medicare Supplement Insurance, aka Medigap, helps cover out-of-pocket costs that Medicare doesn’t.

These plans are standardized - meaning each plan offers the same benefits, regardless of the provider. However, Medicare Advantage plans can offer additional benefits like dental, vision, and wellness programs.

*Note that these come with restrictions on which doctors or hospitals you can visit.

- Fills gaps left by Original Medicare. Medigap covers deductibles, copayments, and coinsurance.

- Offers flexibility in healthcare providers. With Medigap, you can see any doctor that accepts Medicare.

- Some plans offer vision, dental, and hearing coverage. These benefits are typically included in Medicare Advantage plans, not Medigap.

- Limited out-of-pocket maximums. Medicare Advantage plans have a yearly out-of-pocket limit, which Original Medicare lacks.

- No network restrictions for Medigap. Unlike Medicare Advantage plans, Medigap allows you to see any healthcare provider that accepts Medicare.

Preparing for Long-Term Care Expenses

Healthcare needs typically increase with age. Planning for these expenses is absolutely necessary for a worry-free and sustainable retirement.

Medicare only partially covers long-term care, such as nursing homes or in-home care. This leaves a significant gap in coverage.

Out-of-pocket costs can add up very quickly with long-term care. We recommend reading into long-term care insurance.

This coverage helps pay for services Medicare doesn’t. It's smart to explore policies while you're still in good health since premiums can be lower if purchased earlier in life.

Health Savings Accounts (HSAs) and Retirement Healthcare

A Health Savings Account (HSA) can be a powerful tool for covering healthcare expenses in retirement. HSAs allow you to contribute pre-tax money, grow your savings tax-free, and withdraw funds tax-free when used for qualified medical expenses.

This triple tax advantage is hard to beat. Plus, any unused HSA funds can roll over year after year, providing a reliable cushion for healthcare costs down the road. However, to contribute to an HSA, you must be enrolled in a high-deductible health plan (HDHP), so it's important to plan accordingly.

Early Retirement and Healthcare Options

Early retirement is something to be proud of. You have made some excellent decisions to start this new phase at an earlier time than most. One drawback to this is that Medicare does not kick in until you turn 65.

Marketplace Insurance for Early Retirees

The Health Insurance Marketplace offers a viable option for early retirees. You can compare different plans and find coverage that fits your needs until you're eligible for Medicare.

One key advantage is that premium subsidies are available based on your income, which can significantly reduce your costs.

The Role of Medicaid for Low-Income Retirees

Medicaid can help fill the coverage gap if you have a lower income during early retirement,. Medicaid is state-run and provides comprehensive healthcare for those who qualify based on income. Eligibility varies by state, so it's important to check the specific requirements where you live.

Protecting Against Rising Out-of-Pocket Costs

Out-of-pocket costs from healthcare are no joke. However, there are practical ways to manage these rising expenses.

First, make use of preventive care. Routine check-ups and screenings can catch health issues early and save you significant costs down the line. Many plans offer these services at no cost.

Another key step is to negotiate medical bills.

Don’t be afraid to ask for a detailed breakdown or a lower rate—hospitals often have financial assistance programs.

Lastly, always compare drug prices. Different pharmacies and programs may offer better deals, and sometimes, even switching to generics can cut costs significantly.

Reviewing and Adjusting Your Healthcare Plan Regularly

It’s important to review your healthcare plan every year - especially during the open enrollment period.

Our healthcare needs change over time, and so do Medicare benefits and plans.

By reassessing your coverage, you can make adjustments that better suit your current health and financial situation.

Steps to Review:

- Check for changes in Medicare benefits.

- Compare Medicare Advantage and Medigap plans.

- Adjust based on health changes.

Moving Forward: Managing Healthcare Costs During Retirement with Montana Elder Law

Planning for healthcare costs throughout retirement is an essential part of a comprehensive financial plan. These costs can be significant and can come on unexpectedly.

Set aside a little nest egg of savings for unexpected costs and learn as much as you can about Medicare and the options to fill in coverage gaps.

If you or a loved one needs more help with this financial planning for retirement - the expert elder law attorneys at Montana Elder Law are here to provide sound, reliable legal advice to maximize your financial independence during retirement.

Give us a call today or visit us online at Mtelderlaw.com.